The pace of recovery over the next 18 months will define the U.S. economic outlook over the next 3-5 years. Morgan Stanley outlines 4 scenarios for life after COVID.

Even in an era of constant disruption, COVID-19 marks another magnitude of destructive force. Yet, the extent of its lasting damage to the U.S. economy may depend on the next 18 months.

“The more severe the crisis through the end of 2021, the deeper the scars over the next three to five years,” says Ellen Zentner, Morgan Stanley’s Chief U.S. Economist. “On the other hand, a rapid return to pre-pandemic conditions could undo the damage earlier than expected.”

Several factors will influence this outlook, but two variables may prove critical: the timing of a viable vaccine and the severity of consumer risk aversion.

To provide a roadmap for investors and businesses, the U.S. economics team collaborated with AlphaWise—the proprietary survey and data arm of Morgan Stanley Research—and a cross-section of analysts and strategists covering biotechnology, housing, interest rates, macro equities and corporate credit. The collaborative report with their findings outlines four distinct scenarios for life after COVID, ranging from a bull case “Robust Recovery” to a bear case “Deep Scars.” This framework is informed by, and has implications for, virtually every segment of the U.S. economy.

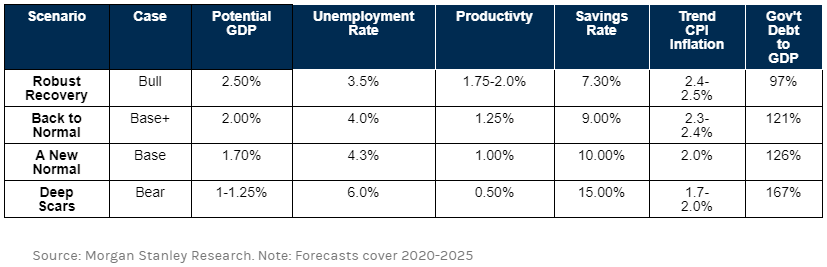

Major Economic Variables Base On Four COVID-19 Scenarios

The prevalence of employees working from home (WFH) remains a key factor, with ramifications for real-estate markets, human capital, consumer spending and technology

An AlphaWise survey fielded in April found that 50% of respondents were WFH. The U.S. economics team’s base case assumes a longer-term 30% WFH rate, double the U.S. Bureau of Labor Statistics’ pre-COVID 15% estimate. A more rapid recovery would likely bring this figure back to pre-COVID levels within the next five years (for more on the impact of WFH trends, see this companion article).

The macro-equity outlook, meanwhile, consistently covers all but the bear-case scenario. “Across most scenarios presented by our economists, the combination of productivity-enhancing investment- and deficit-spending should push longer-term potential GDP back to its pre-COVID pace, or higher,” says U.S. Equities Strategist Adam Virgadamo. “As a result, three of the four outlooks play into our secular bull-market thesis, in which the policy response to COVID-19 strengthens our conviction in a longer-run equity return story.”

Base Case: Navigating a New Normal

Morgan Stanley’s U.S. base-case outlook assumes that a vaccine arrives in the spring of 2021, following a second wave of rising infection rates and business tightening in the fall of 2020.

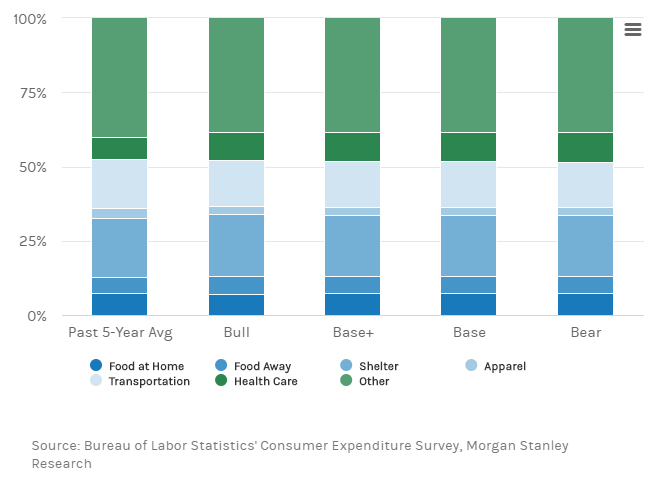

This scenario sees real GDP returning to pre-COVID levels by the end of 2021—but with subdued near-term productivity growth, lower capital expenditures from businesses and higher unemployment levels through 2025. In this case, consumers could remain cautious with wallets, resulting in an elevated savings rate of 10% (pre-COVID it was roughly 7.3%) and subdued spending habits.

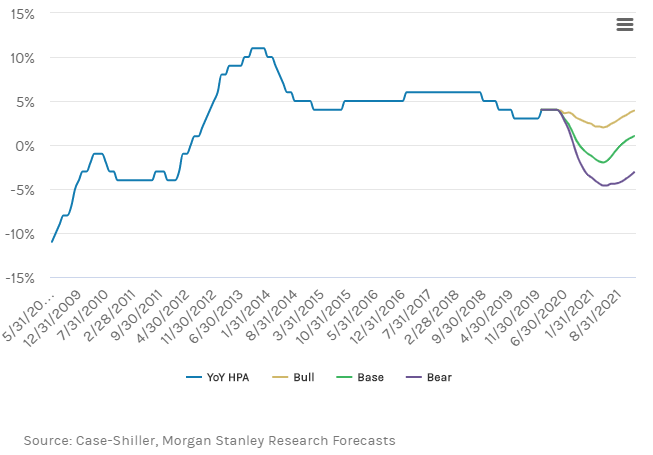

One area where spending could pick up is housing. “In many respects, COVID-19 is accelerating trends in U.S. housing that were already underway,” says James Egan, co-head of U.S. Securitized Products Research, who expects the housing market to stay relatively strong under most recovery scenarios. “We see single-family housing, via both rentership and ownership, as the real beneficiary of more people working from home, and risk aversion potentially fueling an exodus from densely populated areas.”

Home Prices Have Been Supported, Down Just 1% Before Climbing in 2021 (Base Case)

Base Case +: Getting Back To Normal

A slightly more positive scenario, compared to the base case, assumes a viable vaccine in the spring of 2021—but without a severe outbreak in the fall and, consequently, less risk aversion among consumers and businesses.

“Still, given the shift in spending patterns and continued working-from-home arrangements, the savings rate would likely remain above its pre-COVID trend over the longer run,” says Zentner. On the positive, productivity would pick up and help bring GDP growth closer to 2%, enabling growth to resume pre-COVID levels by 2025.

Spending in 5 Year Forecast Pre-COVID vs. Post-COVID

Bull Case: Riding a Robust Recovery

Under the best-case scenario, a vaccine arrives well before the spring of 2021, and low risk aversion among consumers and businesses brings a swift return to life as normal. All told, life after COVID wouldn’t be materially different than before the pandemic.

“A quick return to pre-COVID norms means the economy will likely avoid the depressing effects of a weak cyclical recovery on potential output growth, while some of its side effects—technological adoption and more durable work-from-home arrangements—are likely to remain in place,” says Zentner, whose team’s bull-case outlook pegs average GDP growth at 2.4% through 2025.

This optimistic outlook has unemployment levels falling back to 3.5%, saving levels drifting down to 7.3% and inflation rising 2.5%. Notably, this scenario could double productivity growth to as high as 2%, thanks to greater workforce engagement and technology improvements.

Bear Case: Dealing with Deep Scars

The speed of economic recovery in no small part depends on the development of a vaccine. In their bear-case outlook, Morgan Stanley economists consider the impact of no vaccine for two to five years. This results in a crisis of consumer confidence, a surge in savings, structurally higher unemployment and lasting economic damage.

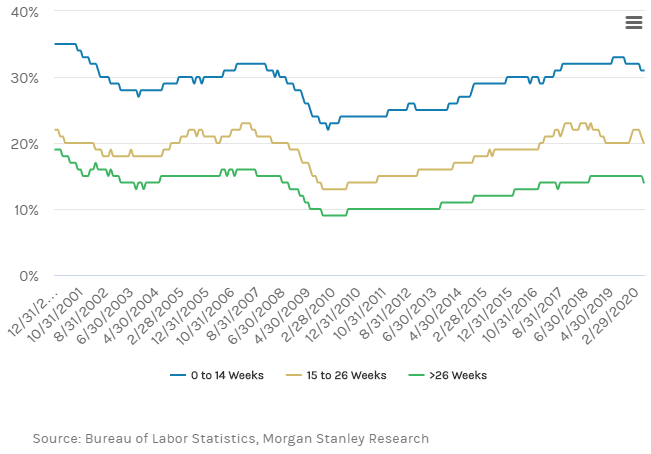

“Should more unemployment become permanent, rather than temporary, the effects on the labor market can be significant over time,” Zentner says. “The long-term unemployed are less likely to find new employment and are also more likely to drop out of the labor force altogether.”

The Long-Term Unemployed Are Less Likely to Become Re-Employed

(Probability of Re-Employment by Employment Duration)

In a notable departure from the other three scenarios, if the current uncertainty persists for years to come, the macro equities outlook would darken considerably, and corporate credit would likely enter a significant default cycle, driven by a sharp and sustained contraction in earnings.

In the near term, the economic impact of business closures and elevated unemployment would be a headwind for housing markets as well. Over the longer term, however, risk aversion, coupled with more permanent WFH arrangements, could drive up demand for single-family homes, particularly in more affordable regions.

For more Morgan Stanley Research on COVID-19 and the U.S. economic outlook, ask your Morgan Stanley representative or Financial Advisor for the full report, “Life After COVID” (Jun 21, 2020). Plus, more Ideas from Morgan Stanley’s thought leaders.